Level Money (Misberri / Presence PG)

Swift rewrite of Level MoneyNovember 2015 - April 2016

ROLEiOS Engineer contractor (through Misberri & Presence PG)

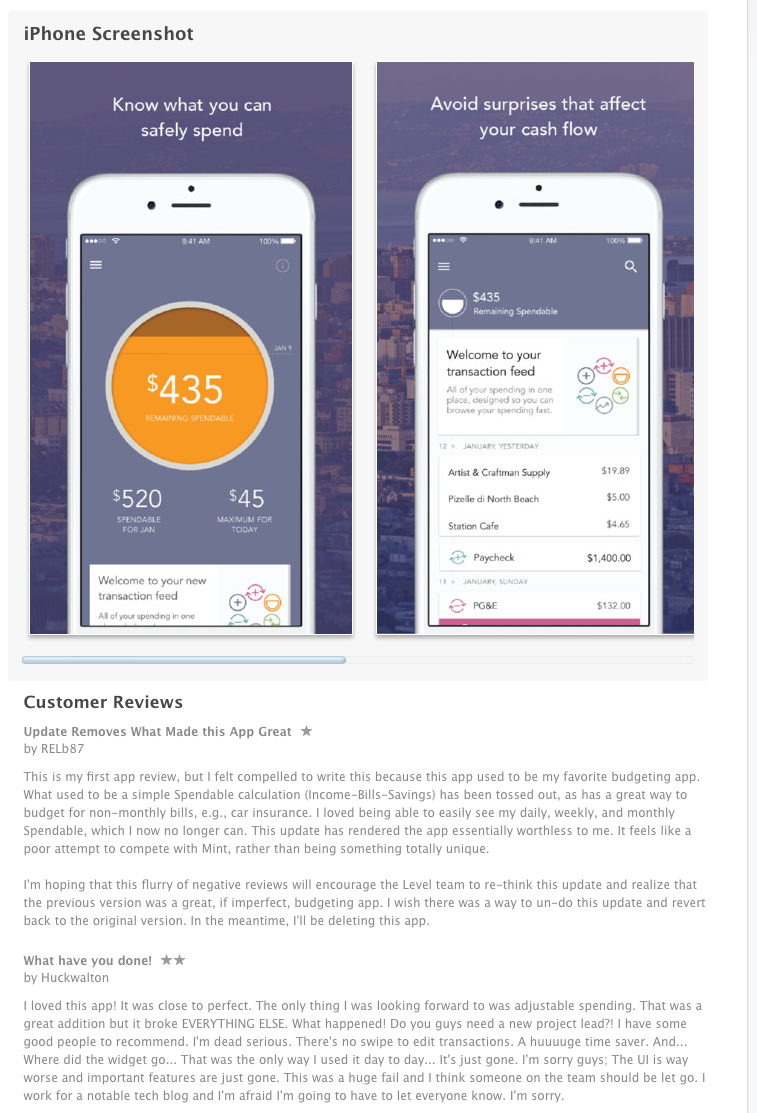

I was hired as a contractor to help the Level Money team rewrite the app in Swift. The app was also redesigned to be more modern and user-friendly. Unfortunately, the new version disappointed its users because it was not as feature rich as the original version. The choice had been to radically simplify the app to the essentials that guide users’ spending decisions.

Simplified design v3.0

The formula for calculating the spendable budget was changed. The analogy that informed the design was that of a weight loss app that focuses on how much you’ve eaten as opposed to how much you’ve lost. How much you’ve spent as opposed to what you’ve saved.

Main Findings

(But maybe not the right product decisions…)

- Behavioral framing matters: the team leaned into a “financial fitness” analogy, like calorie counting for money. It was designed to encourage frequent engagement, honesty, and focus on daily actions rather than just long-term savings.

- Actionability over accuracy: the product favored simple, digestible insights (“what you’ve spent”) instead of technically precise but harder-to-interpret financial data.

- Psychological nudges: small wins and visibility into spending were prioritized over traditional budgeting categories.

- Engagement model: a more frequent check-in pattern was assumed (like daily fitness tracking) rather than occasional financial reviews.

Objective Difficulties of Building a Personal Finance App

Regardless of framing, there are hard problems every PFM app struggles with:

- Bank connections are fragile: integrations often break, require reauthentication, or have delays—leading to frustrated users.

- Data accuracy & categorization: transactions arrive with cryptic merchant codes, inconsistent labels, or missing details; automated categorization is error-prone.

- Unpredictable income: irregular paychecks, freelance work, and cash inflows make forecasting difficult.

- Fuzzy billing cycles: bills don’t always align neatly with monthly calendars, which confuses “budget left” logic.

- Coverage gaps: cash transactions, partner accounts, or financial institutions outside the integration network create blind spots.

- Onboarding burden: asking users to link multiple accounts and trust the app with sensitive data is a high barrier to entry.